How much is Social Security in the US? This comprehensive guide will delve into the intricacies of Social Security benefits, empowering you to maximize your retirement income. From eligibility requirements to calculating payments, we’ll cover everything you need to know to secure your financial future.

Understanding the nuances of Social Security is crucial for planning a secure retirement. This guide will provide a clear roadmap, ensuring you receive the maximum benefits you’re entitled to.

Understanding Social Security Benefits

Social Security is a federal insurance program that provides financial assistance to retired workers, disabled individuals, and their dependents. It is funded by payroll taxes paid by workers and employers and is intended to provide a safety net for those who can no longer work due to age, disability, or death.

To be eligible for Social Security benefits, individuals must have worked and paid Social Security taxes for a certain number of years. The amount of benefits received is based on the individual’s lifetime earnings and the age at which they retire.

Types of Social Security Benefits, How much is Social Security in the US?

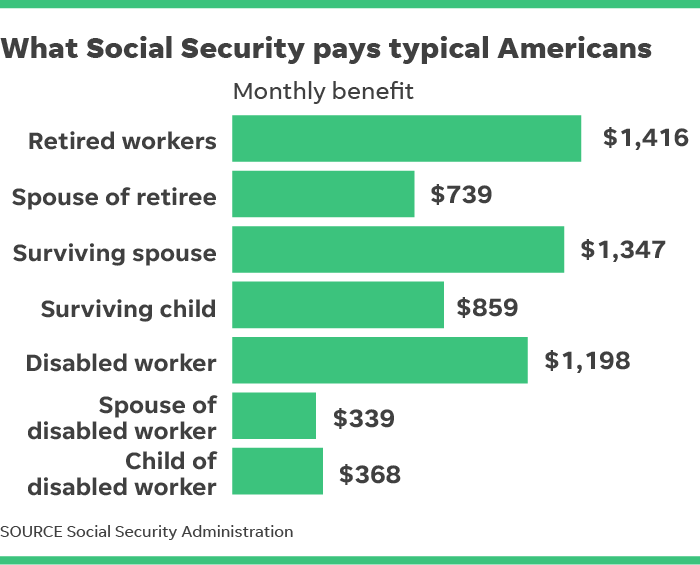

- Retirement benefits: Paid to retired workers who have reached the full retirement age, which is 66 for those born in 1943 or later.

- Disability benefits: Paid to individuals who are unable to work due to a disability that is expected to last for at least 12 months or result in death.

- Survivor benefits: Paid to surviving spouses, children, and parents of deceased workers who were receiving or were eligible for Social Security benefits.

Calculating Social Security Payments

The amount of Social Security benefits received is determined by several factors, including:

- Average indexed monthly earnings (AIME): This is a measure of the individual’s lifetime earnings, adjusted for inflation.

- Primary insurance amount (PIA): This is the basic benefit amount that an individual is eligible for at full retirement age.

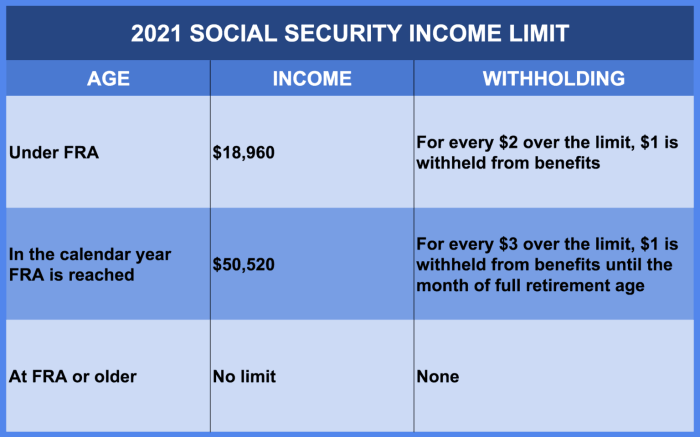

- Age at which benefits are claimed: Benefits are reduced if claimed before full retirement age and increased if claimed after full retirement age.

To calculate Social Security benefits, follow these steps:

- Determine your AIME by averaging your highest 35 years of earnings, adjusted for inflation.

- Calculate your PIA using a formula provided by the Social Security Administration.

- Adjust your PIA based on your age at which you claim benefits.

Maximizing Social Security Income

There are several strategies that individuals can use to maximize their Social Security benefits, including:

- Delaying retirement: Benefits are increased by 8% per year for each year that retirement is delayed beyond full retirement age, up to age 70.

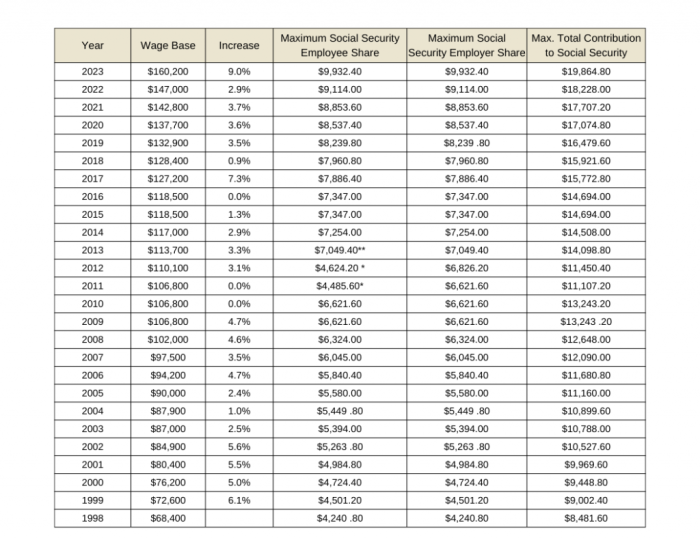

- Earning additional income: Working and paying Social Security taxes can increase your AIME and, therefore, your PIA.

- Coordinating with other benefits: Social Security benefits may be coordinated with other government programs, such as Medicare and Medicaid, to ensure that individuals receive the maximum benefits available.

Related Information

In addition to Social Security benefits, there are other government programs that provide financial assistance to individuals who are retired, disabled, or have low incomes.

- Medicare: Provides health insurance coverage for individuals who are 65 or older, disabled, or have end-stage renal disease.

- Medicaid: Provides health insurance coverage for individuals with low incomes and limited resources.

Individuals can obtain personalized Social Security benefit estimates by creating an account on the Social Security Administration’s website.

Outcome Summary

In conclusion, Social Security plays a vital role in retirement planning. By understanding the factors that determine your benefits and implementing strategies to maximize your income, you can ensure a comfortable and secure retirement. Remember, planning ahead is key, so start exploring your options today.

FAQ Section: How Much Is Social Security In The US?

What is Social Security?

Social Security is a government program that provides financial assistance to retired workers, disabled individuals, and survivors of deceased workers.

How do I qualify for Social Security benefits?

You must have worked and paid Social Security taxes for a certain number of years to qualify for benefits.

How much will I receive in Social Security benefits?

The amount of benefits you receive depends on your earnings history, age at retirement, and other factors.

Can I increase my Social Security benefits?

Yes, you can increase your benefits by working longer, earning more money, and delaying retirement.